The story behind the gut-wrenching US$300 drop in gold prices.

Many ways to skin a cat

In the last 50 years under the guise of ‘modern’ economics, some fundamental truths have been forgotten. Importance of gold in the world monetary system is one of these ‘forgotten’ truths.

This has damped down gold prices – and printing presses have been busy printing money. Especially in the last 40 years – after the Nixon Chop.

24 hour coverage of financial markets has also created an impression that financial cycles play out in a matter of hours and days. So also, the the drop in gold prices of the last two weeks.

Many people have been puzzled over the last few months by gold’s (GC2G -0.19%) behavior. It has tumbled since the start of September from around $1,900 an ounce to below $1,600. This has happened even while a financial crisis has erupted in Europe which, says traditional analysis, should be bullish for gold.

But there are a couple of other factors at play.

First: Gold hasn’t fallen as far as it looks. The gold price is typically quoted in U.S. dollars. Yet in the past four months the dollar has rallied.

At the start of September, when gold touched $1,900 an ounce, the dollar was $1.45 to the euro. Since then the euro has slumped to $1.30.

Net result? Gold, which traded at around 1,300 euros per ounce back then, has declined to 1,200 euros per ounce now.

The second factor: Sentiment.

Four months ago, sentiment was massively bullish on gold. It had just skyrocketed, in the wake of the U.S. debt ceiling debacle. According to data published by the Commodities and Futures Trading Commission, speculators and traders had taken nearly record speculative bets that it would rise further.

This usually precedes a backlash, and so it has been.

Today? Sentiment is pretty bearish. The CFTC says the number of speculative bets on higher gold have collapsed by more than a third. (via Will the Europeans have to sell their gold? – Portfolio Insights by Brett Arends – MarketWatch).

A bump on the road

The first 15 days of December, 2011, has seen weakness in gold prices – falling from roughly US$1900 to US$1600. The biggest drop, after ‘gold dropped 25 percent in the fall of 2008 — from over $1,000 an ounce to about $750′. Broad parameters of the situation were similar then – as now.

In 2008, the US economy was tanking, and gold was at psychological barrier of US$1000. This time around gold is at US$2000 psychological mark. And it is feared that the Euro-zone may collapse.

“The worst case scenario (a euro zone break-up) was pretty much ridiculous a year ago but it is now becoming more and more possible, to say the least,” Juan Valencia, credit analyst at Societe Generale, said.

This time around

So, what are the specifics now.

First are the European banks. It is reported

banks face about 320 billion euros in senior and government guaranteed debt redemptions next year. By comparison, they had issued just 12 billion euros of debt in the past six months.

With no solution to the euro zone debt crisis in sight, interbank market players say they are reducing credit lines to an ever increasing number of banks.

“It is utter madness … When we see big names paying 300 basis points over overnight rates for dollars you know something is wrong,” said the head of money markets at a bank in London, who asked not to be named.

“Credit lines have already been reduced, we are seeing the big names paying through the nose for cash from corporates as wholesale is pretty much dead. The focus now is for the core banks to raise cash through the retail/corporate space. Central banks may be called upon.”

French banks’ borrowing from the ECB topped 100 billion euros in the maintenance period ending November 8, compared to 87 billion euros the month before. French banks are more exposed than any those of any other euro zone country to Italian, Spanish and Greek debt, with holdings in excess of 600 billion euros, according to Bank for International Settlements data.

Of the contributors to daily Libor rates, French banks BNP Paribas, Credit Agricole and Societe Generale say they pay the most for three-month dollars, around 0.6 percent. But dollar rates have recently been on the rise for other core country banks as well.

In such an environment liquidity is at a premium. Some investors are even taking money out of banks and paying to keep it in short-term German or Dutch government paper, which is trading with negative yields.

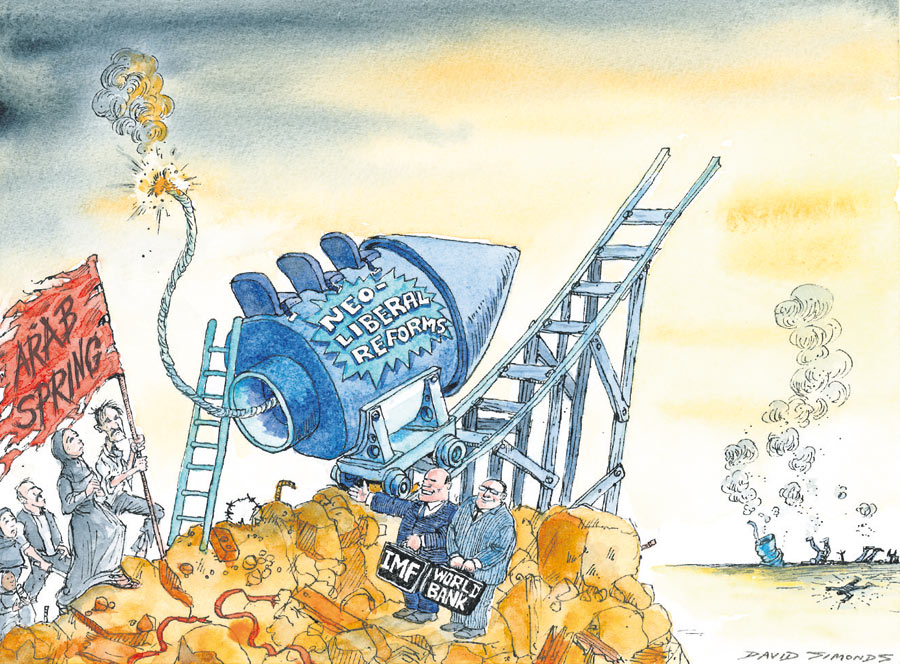

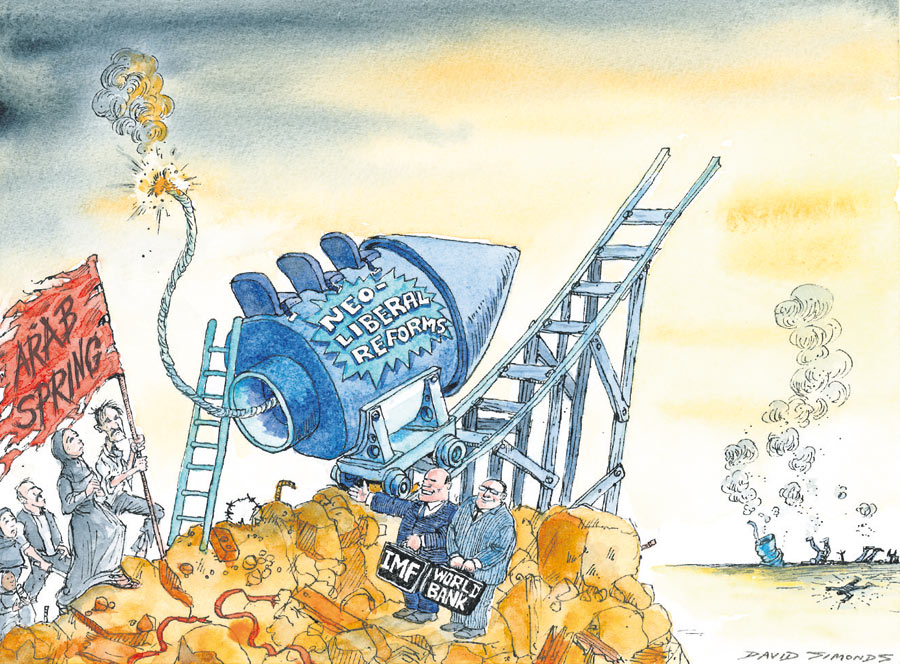

Where has all that yellow stuff gone? Buried under a mound of silence? | Cartoonist - Dave Simonds on 18-6-2011 in guim.co.uk | Click for larger image.

Where is gold coming from

Negative yield brings us to another grey area.

Gold lending at negative rates. Europe has an organized market where gold owners can lend gold to borrowers – at rates varying between 0.5% to 2%. There are ominous whisper-reports.

The partnership between the Federal Reserve and European Central Bank to provide hundreds of billions of relatively low-cost dollars for euro-area banks should have relieved the pressure to come up with greenbacks. Yet gold market people say European commercial banks are being driven to lend gold for dollars at negative interest rates just to raise some extra cash for a few weeks. There’s not a lot of transparency about where the banks are getting the gold they are lending out, but it could be lent to them by either their national central banks or by gold exchange-traded funds.

There is also a third source of gold that is being lent in the market. Gold that does not belong to any European Governments or to any ETF.

But obtained from deposed Middle East rulers of Egypt, Tunisia, and Libya.

Cash is king

Regardless of the source of gold, the cash situation at European banks remains a trigger for this gold sell-off.

The need for cash has overwhelmed gold’s traditional status as a safe haven in past few months, putting the metal on course for its first quarterly fall since end-September 2008 when the global credit crunch was at its worst.

“With access to liquidity being constrained, market participants have increasing problems to refinance,” Credit Suisse said in a research note. “As a result they have to sell their assets – including precious metals – to raise the much needed cash. This is the main reason why gold prices fall on days of increasing funding stress.”

This has obviously raised concerns in the Asian markets – the main buyers of gold. This extra supply of gold from European banks has led to a sell-off – led by Asian markets.

In recent weeks the gold price has fallen significantly from around $1900 to $1535 (intraday). Gold is now trading near Q3 target of $1650. The size of the move was far more significant compared to other recent unwinds, like those in May or August. One of the key factors for long-term bullish view on gold is Asian demand – the majority of end-user demand for gold is from Asia. From an Asian valuation perspective, gold is also relatively cheap.

One way to proxy Asian demand for gold is to look at how gold performs during Asian trade. Over the past few years, gold has generally appreciated during Asian hours, reflecting strong demand for the metal. However, recent weeks have shown weakness in Asian hours. On previous occasions when gold traded poorly, such as in May and August, it remained relatively robust during Asian hours, with any sell-off tending to come in London and New York hours, suggesting that Asian investors were supporting an unwind of Western investors’ long gold positions.

This contrasts with the recent fall, noticeable across multiple time zones. In the very short term, we believe a reversal would need to be led by appreciation in Asia. Although a few data points do not constitute a trend, on Tuesday and Thursday gold rose by 2%, its largest moves higher during Asian hours since October 2008 and perhaps a signal that it could be turning back up.

Gold often trades like a risky asset. This has been evident in recent weeks where we have seen a strong positive correlation between gold and the S&P500, which we use as a proxy for risky assets. The rationale is that heavy losses in risky assets forces investors to unwind other positions to free up cash. As a liquid asset and also with heavily extended net long speculative positioning heading into this episode, gold has suffered.

The price-drop also generated sell-orders based on stop-loss triggers at US$1700. For the time being the stampede has abated. Asian markets were at the forefront of some investment demand.

Gold rebounded in thin trading during the Asian session Friday, paring some of this week’s losses with traders expecting gains to hold in the near-term with some dip buying likely amid a modest bounce in stock markets. The yellow metal rose more than 1% in the session to a high of $1,589.90 a troy ounce after falling for four consecutive days this week.

A Hong Kong-based trader said there is some investment demand, which is driving up prices. Some speculators have also returned to the market after prices fell sharply this week. Despite the slight improvement in sentiment, however, investors continued to be wary of the European sovereign debt crisis.

There is hardly any dissonance between various reports – which supports a belief that this may have a momentary technical correction before gold breaks the US$2000 per ounce barrier. In a year, where most asset classes have performed badly and market volatility took away whatever little was left on the table, fund managers may have locked in their profits on gold for the year. Remember, this is also the time of the year, when bonuses get calculated. The long-term fundamentals of the gold remain beyond argument.

Even in the short-term, this maybe a buying-opportunity one may regret having missed.

.jpg)

9 comments:

The post is written in very a good manner and it entails many useful information for me. I appreciated what you have done here. I am always searching for informative information like this. Thanks for sharing with us.

Good blog information about gold intraday trend.I really appreciate your work,the way you describe each and every point is amazing.Thanks for sharing.

stock market

Money Maker is an Advisory Company For Share, Stock Market Which provide tips such as Free Stock Tips,Stock Market Tips,Jackpot Calls,Sure Shot Stock tips, research domestic market and provide Accuracy. More Information Visit Our Web site http://www.moneymakerfinancial.com.

Hi good stuff of information, thanks for giving such information, i am always ready to read about equity tips , thanks

Your information was absolutely right ,I appreciate your post and looking more updates for your site.

Visit- http://stock-cash-future-tips.blogspot.com/

nice post...

did you know I make huge amount of money in commodity market? Well I do and I want to show you how you can do the same...Stock Tips

Good informative content for me. I am really impressed you’re designing and it’s posting accurate Regards MCX Gold Silver Tips.

I read your article and its really informative and nice.Best Tips Company sharing daily updates.

Post a Comment